To view this discussion visit https://groups.google.com/d/

Wednesday, December 31, 2025

Mini nuclear reactors are already losing their glow

Monday, December 22, 2025

These 15 Coal Plants Would Have Retired. Then Came AI and Trump

These 15 Coal Plants Would Have Retired. Then Came AI and Trump.

Posted on by Conor Gallagher

By Joe Fassler, a writer and journalist whose work on climate and technology appears in outlets like The Guardian, The New York Times, and Wired. His novel, The Sky Was Ours, was published by Penguin Books. Cross posted from DeSmog.

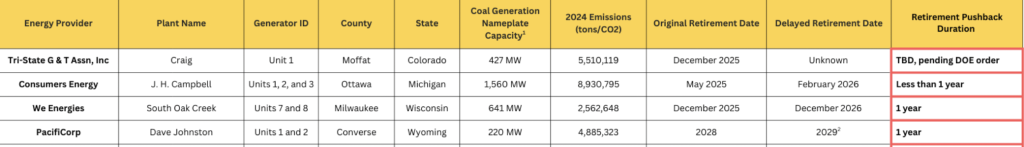

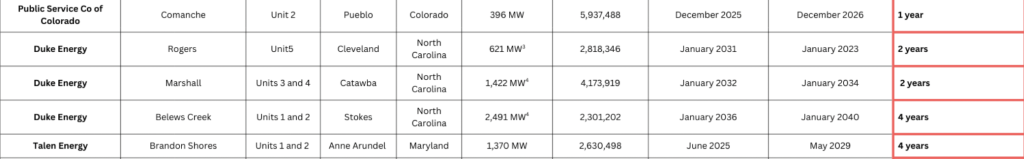

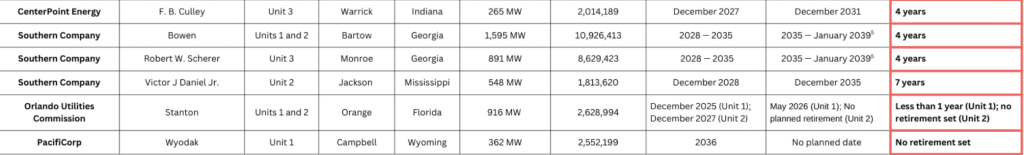

Since the second Trump administration took power in January, at least 15 coal plants have had planned retirements pushed back or delayed indefinitely, a DeSmog analysis found.

That’s mostly due to an expected rise in electricity demand, a surge largely driven by the rise of high-powered data centers needed to train and run artificial intelligence (AI) models. But some of the plants have been ordered to stay open by the U.S. Department of Energy (DOE), despite significant environmental and financial costs. Energy Secretary Chris Wright, a former fracking executive, has frequently cited “winning the AI race” as a rationale for re-investing in coal.

The fossil fuel facilities are located in regions across the country, from Maryland to Michigan and Georgia to Wyoming. Together, their two dozen coal-fired generators emitted more than 68 million tons of carbon dioxide in 2024. That’s more than the total emissions of Delaware, Maryland, and Washington, D.C. combined.

Nearly 75 percent of the coal plants were on track to shutter in the next two years.

The delays buck the overall trend in the U.S., where coal’s importance as an energy source has diminished rapidly over the past two decades. Coal’s critics say this broad-based phaseout is an urgent matter of public and environmental health. Often called the “dirtiest fossil fuel,” coal creates more climate emissions per gigawatt-hour of electricity than any other power source. And the human impacts of its pollution have been profound: A 2023 study in Science attributed 460,000 extra U.S. deaths between 1999 and 2020 to sulfur dioxide particulate pollution belched out by coal plants.

Cara Fogler, managing senior analyst for the Sierra Club, called the recent spate of delayed closures “unacceptable.”

“We know these coal plants are dirty, they’re uneconomic, they’re costing customers so much money, and they’re polluting the air,” said Fogler, who co-authored a report showing many utilities have backtracked on climate commitments, including coal phaseouts, often citing data centers as a cause. “They need to be planned for retirement, and it’s really concerning to see utilities becoming so much more hesitant to take those steps.”

DeSmog identified the 15 plants by examining changes to the planned retirement dates listed by the U.S. Energy Information Administration (EIA), a DOE agency that compiles data on energy providers, as well as public statements from utilities and the Trump administration. Some of the voluntary delays appear to directly contradict previous net-zero pledges made by several companies.

Neither the Department of Energy nor American Power, a trade association representing the U.S. coal fleet, responded to requests for comment.

What Led to Coal’s Decline?

Not long ago, coal really did keep the lights on. In 2005, it provided roughly half of America’s electricity, making it by far the dominant power source nationwide. But in the past two decades, coal’s market share has rapidly waned. No new coal plants have come online since 2013. These days, its footprint has dwindled, with just 16 percent of the overall energy mix.

In March 2017, President Trump appeared to blame environmental regulations for coal’s poor fortunes — a trend he promised to reverse.

“The miners told me about the attacks on their jobs and their livelihoods,” Trump said at U.S. Environmental Protection Agency (EPA) headquarters. “I made them this promise … My administration is putting an end to the war on coal.”

But environmental regulations didn’t kill coal. Instead, its demise became inevitable mostly thanks to the rise of a competing fossil fuel: natural gas.

Gas has both economic and technological advantages over coal, said David Lindequist, an economist at Miami University who co-authored a recent paper on the environmental impacts of the shale gas boom.

As new fracking technologies helped to flood the U.S. market with cheap gas in the mid-2000s, utilities began a broad coal-to-gas pivot that’s still underway today. Abundant, often less expensive gas flowed into power plants that operate more efficiently and nimbly than coal plants. This combination of price, efficiency, and flexibility made ditching coal an easy calculation for many utilities.

“The fact that we were able to so successfully phase out coal in the U.S. would never have happened without the fracking boom,” Lindequist said.

Today, coal is at an even greater disadvantage, as renewable energies continue to make economic and technological inroads. The International Renewable Energy Agency found that, in 2024, solar and wind routinely delivered electricity more cheaply than fossil sources of energy. That dynamic has helped solar in particular become the fastest-growing source of power in the U.S.

Meanwhile, America’s newest coal plant — the Sandy Creek plant near Waco, Texas, built way back in 2013 — is currently sitting idle after another catastrophic failure. It isn’t set to resume operations until 2027. The average U.S. coal plant is more than 40 years old, a factor that’s contributed to their decreasing reliability.

“These [coal] plants are so old that at this point there’s very little that could really revive the fleet,” said Michelle Solomon, manager in the electricity program at the nonpartisan think tank Energy Innovation. “I’ve been using the analogy of an old car: Nothing is going to bring my car that has 200,000 miles on it back to being a brand new, efficient car.”

During the Biden years, as technological advancements and historic subsidies made renewables even more attractive, observers broadly believed that coal’s days were numbered. The “writing was on the wall” for coal, Lindequist said.

“Coal may retain a grip in U.S. politics, but its actual role in the generation system is shrinking annually,” researchers for the Institute for Energy Economics and Financial Analysis wrote in a 2024 report. “It is a trend we believe is irreversible.”

Yet even before Biden left office, a new dynamic began emerging: As tech companies started proposing billions in data center build-outs to feed the AI frenzy, utilities started to take a fresh look at their coal plants.

Data Centers Changed Coal’s Trajectory

In 2020, Dominion Energy, a utility that provides electricity to millions of customers across Virginia, North Carolina, and South Carolina, announced non-binding plans to retire the Clover Power Station by 2025. Running the plant — an 877 megawatt (MW) coal-fired facility near Randolph, Virginia — would be uneconomical under any future scenario, the company found. It just didn’t make financial sense to keep it going.

It reversed course just three years later. Under its 2023 plan, Dominion projected that its energy demand from data centers would nearly quadruple by 2038. That’s an astonishing rise, considering that Virginia already leads the U.S. in data center development by a wide margin. Known as Data Center Alley, the state is home to more than one-third of the world’s largest-scale data centers. Today, Dominion says it doesn’t anticipate retiring any of its existing coal plants — including Clover — until at least 2045, the year that Virginia law stipulates its economy must be carbon-free.

Dominion wasn’t the only utility to cite data center growth as it backtracked on coal. In an August 2024 earnings call, executives of the Wisconsin-based utility Alliant Energy said that the company was “proactively working to attract” data center projects. A few months later, Alliant announced it would delay retiring the Columbia Energy Center, a coal-fired plant near Madison, from 2026 to 2029. The plant’s retirement had already been pushed back once.

Utilities have delayed the retirements of at least 15 U.S. coal plants since President Trump took office in January 2025. Data source: U.S. Energy Information Administration. Credit: Joe Fassler/DeSmog

The trend became notable enough to attract the attention of analysts at Frontier Group, an environmental think tank. In January 2025, Frontier analyst Quentin Good published a white paper showing that utilities had already cited data center growth as a rationale for delaying the phaseout of seven fossil fuel power plants across the U.S.

“We were concerned about the potential for all of this new electricity demand from data centers to slow down the transition to clean energy,” he told DeSmog. “In that report, we discovered it was basically happening already.”

But two other dynamics also began playing out in January: AI hype started to reach new levels of intensity, and power changed hands in Washington.

AI Hype Highs, New Coal Lows

Data centers aren’t the only reason for the recent upswing in electricity demand. Building electrification, industrial growth, and increased electric vehicle ownership all play roles, too. But nothing has quite caught utilities’ attention like data center projects, which are cropping up with highly localized impacts across the U.S. at a historic rate. Filled with stacks of high-powered computing equipment, the facilities are projected to account for about half of new electricity growth between 2025 and 2030.

On January 21, 2025 — one day after President Trump’s second inauguration — he revealed a new AI infrastructure joint venture involving ChatGPT parent company OpenAI called the Stargate Project, which would spend up to $500 billion on data center build-outs in the next four years. Tech executives announced the initiative’s details alongside Trump during the unveiling at a White House event.

Days later, Meta CEO Mark Zuckerberg said he planned to spend $65 billion on data center build-outs in 2025 alone, including one project “so large it would cover a significant portion of Manhattan.” These announcements followed a similar one from Microsoft in January: a pledge to spend $80 billion on data centers this calendar year.

As the world’s largest tech companies raced to outdo each other, a wave of delayed coal plant retirements followed.

On January 31, Southern Company, a utility serving over 9 million customers across 15 states, announced plans to delay the retirement of generators at two of the largest coal plants in the U.S., both in Georgia. The massive, coal-fired units — two at the Bowen Steam Plant outside Euharlee, and one at the Robert W. Scherer Power Plant in Juliette — had been scheduled to go offline between 2028 and 2035. Under its revised plan, the company pushed retirement back to as late as January 1, 2039(though both plants would be 40 percent co-fired with natural gas by 2030 in that scenario).

In legal documents and public statements, company spokespeople point to data centers as a key rationale for the delays. Last month, at an industry conference in Las Vegas, Southern Company CEO Chris Womack cited data center growth as a key factor keeping fossil energy online, according to the trade publication Data Center Dynamics.

“We’re going to extend coal plants as long as we can because we need those resources on the grid,” he reportedly said.

Next door in Mississippi, Southern Company also delayed the closure of a 500 MW generator at the Victor J. Daniel coal plant in Jackson County. It pushed the retirement back from 2028 until “the mid 2030s.” In documents filed with Mississippi’s Public Service Commission, the state’s utility regulator, Southern appeared to cite a 500 MW Compass Datacenters project as a reason for the change. Southern has pledged to be net-zero by 2050.

As the months passed, the same dynamic unfolded in other states. Alarmed, Good, the Frontier Group analyst, started to track the delays. By October, he published an update to Frontier’s report that found data centers had pushed back at least 12 coal plant closures in the past few years.

“The data center boom has shown no signs of abating,” he wrote. “Even more fossil fuel plants that had been scheduled to retire have been given a new lease on life.”

In its own analysis, DeSmog found that at least 15 coal plant retirements have been delayed since January 2025 alone. Together, those plants emitted nearly 1.5 percent of America’s total energy-related carbon dioxide emissions from 2024.

This comes at a time when the world’s nations need to cut their climate emissions roughly in half to avoid the worst impacts of global heating, according to a recent United Nations report.

But not all the delays can be attributed directly to data center growth. Some have stayed open for a different reason: top-down orders from the Trump administration.

The Department of Energy Steps in

The J.H. Campbell Generating Plant, a 1.5 gigawatt coal plant in Ottawa County, Michigan, was scheduled to close May 31. The plant even held public tours to give a rare, behind-the-scenes look at aging fossil infrastructure, before it shut its doors for good.

“Now we know cleaner, renewable ways to generate electricity,” a Campbell employee told members of the public on a September 2024 tour.

But just eight days before scheduled to shutter, Department of Energy Secretary Chris Wright ordered Campbell to stay open another 90 days, citing an “emergency” shortage of energy in the Midwest.

Keeping the plant open cost its owner, Consumers Energy, almost $30 million in just five weeks, the company said. Though the plant’s closure was projected to save ratepayers more than $650 million by 2050, Campbell was costing more than $615,000 a day as of September. Yet Wright has since extended his order twice. Campbell now is scheduled to stay open until at least February 2026.

“The costs to operate the Campbell plant will be shared by customers across the Midwest electric grid region,” including customers serviced by other utilities, Matt Johnson, a Consumers Energy spokesperson told DeSmog by email.

Michigan Attorney General Dana Nessel is challenging DOE’s order to keep Campbell open, calling the orders “arbitrary.”

“DOE is using outdated information to fabricate an emergency, despite the fact that the truth is publicly available for everyone to see,” Nessel said in a November 20 press release. “DOE must end its unlawful tactics to keep this coal plant running when it has already cost millions upon millions of dollars.”

Meanwhile, DOE is telling a very different story.

“Beautiful, clean coal will be essential to powering America’s reindustrialization and winning the AI race,” Wright said in September, as the Department of Energy announced $350 million in funding for coal plant upgrades, along with other incentives.

Energy Innovation’s Solomon called the funding “a waste of taxpayer dollars.”

“We’ve been calling it a ‘cash for clunkers’ program where you don’t trade in the clunker,” she said. “Trying to build a modern electricity system using the most expensive and least reliable source of power is really not the answer.”

However, the Trump administration said in September that it plans to feed the AI boom — with an estimated 100 gigawatts of capacity in the next five years — by keeping more old coal plants open. “I would say the majority of that coal capacity will stay online,” Wright said.

Executives from Colorado’s Tri-State Generation and Transmission Association confirmed to DeSmog that they also expect an order to keep a 421 MW coal-fired generator at Craig Station open past its December 2025 decommissioning date.

In late October, Colorado Congressman Jeff Hurd sent a letter to the Trump administration, urging it to extend the life of a 400 MW coal generator at the Comanche Power Station near Pueblo as the owner, Xcel Energy, works to repair the plant’s chronically troubled main reactor. The smaller unit was slated to go offline in December — but, in its case, the administration never needed to act. Last month, Xcel, with the help of Colorado Governor Jared Polis, began to lobby to keep it open at least another 12 months. The state utility regulator appears to have granted that request, according to an agreement with Xcel and other stakeholders.

This delay wasn’t just due to data centers, though their numbers are growing in Colorado. Xcel spokesperson Michelle Aguayo said the delay was “due to a convergence of issues,” including rising electricity demand, “supply chain challenges,” and the continued outage at the main generator. “We continue to make significant progress towards our emission reduction goals approved by the state which would require us to retire our coal units by 2030,” she said.

Delaying the Inevitable

Whether the data center boom will play out as projected is still a matter of speculation.

Last month, power consulting firm Grid Strategies reported that utilities may be overestimating electricity demand from data centers by as much as 40 percent. That’s due in part to the many hypothetical projects, and a widespread practice of double- and triple-counting. Tech companies tend to pitch utilities in multiple regions as they shop around for incentives, creating the appearance of demand from many more data hubs than actually will be built.

Experts have a name for this growing phenomenon: “phantom data centers.”

At the same time, a growing chorus of critics are warning of an AI bubble, arguing that runaway costs can’t justify the kinds of investment being floated. Even the head of Google’s parent company has acknowledged the “irrationality” of the boom.

Critics also say contradictory actions taken by the Trump administration — citing an “energy emergency” while canceling billions in funding for renewable projects — are making the problem worse.

Yet even with all the unknowns, one thing’s certain: Coal’s role in America’s power push can be extended, but it can’t last forever.

Seth Feaster, an IEEFA analyst, says even AI hasn’t changed the big picture: Eventually, coal will die, and it will be killed by other, cheaper forms of energy.

He called the current phenomenon a “period of pause and delay.” In his view, the technological and economic rationales for quitting coal remain undeniable.

“The policy changes here may have a delaying effect on the decline of coal, but they are certainly not changing the direction of coal’s future,” he told DeSmog.

The questions for now are, how long the delays will continue — and at what cost.

Are Utah leaders’ energy ambitions going to nuke your wallet?

Are Utah leaders’ energy ambitions going to nuke your walllet?

Utah’s largest electrical utility asked the commission in October to approve a contract to bring in power from the Terra Power nuclear plant under construction in Wyoming. The plant will be a unique design intended to store nuclear-generated heat in molten salts so it can ramp up and down faster to integrate with fluctuating solar and wind power.

But there is no history to back that up, and Rocky Mountain needs Utah’s commitment soon to qualify for federal funds to finish the plant. The case already has attracted attorneys from Utah industries looking to protect their power costs.

SD Williams

After recent SONGS radioactive release, masses of dead lobsters are washing up on beaches

Saturday morning (Dec.20, 2025) there were hundreds of dead lobsters washed up on the beaches between Trestles Beach in San Clemente and San Onofre Beach near the San Onofre Nuclear Power Plant (SONGS). Below are some photos.

Release Notification

Notice Date: December 9, 2025

Est. Start Date: December 11, 2025

Volume: 37,802 gallons

NRC Proposes $72,000 Civil Penalty Against Missouri-based Company

NRC Proposes $72,000 Civil Penalty Against Missouri-based Company

Thursday, December 18, 2025

New of the Weird: Axios: Trump's media company to merge with nuclear fusion startup

Trump's media company to merge with nuclear fusion startup

Ben Geman | 12/18/25

Ben Geman | 12/18/25

Illustration: Axios Visuals

Trump Media & Technology Group is merging with nuclear fusion power startup TAE technologies in an all-stock deal valued at $6 billion.

Why it matters: The unusual combo would expand the president's business interests into the heavily regulated nuclear space.

- It will provide new resources to the fusion player, and signals Trumpworld's enthusiasm about a potentially big power source, which faces big scientific and cost hurdles to become viable.

- It also shows how AI's voracious power needs are drawing investment into both existing and, in this case, frontier energy technologies.

Driving the news: The deal will provide TAE up to $200 million in cash at signing, and another $100M is available upon formally notifying the SEC of the deal, the companies said.

- Former GOP congressman Devin Nunes, who is TMTG chairman and CEO, and Dr. Michl Binderbauer, TAE CEO and director, plan to serve as Co-CEOs of the combined company, the parties said.

- Neither company immediately returned an Axios request for comment.

Our thought bubble: The deal represents a massive pivot for TMTG, which had lost about 70% of its value this year through Wednesday.

Our thought bubble: The deal represents a massive pivot for TMTG, which had lost about 70% of its value this year through Wednesday.

- Though the company has branched out into financial products, AI, streaming and more, none of those changes moved the needle like the pivot to nuclear, which caused TMTG shares to spike more than 30% in premarket trading Thursday.

What we're watching: "In 2026, the combined company plans to site and begin construction on the world's first utility-scale fusion power plant (50 MWe), subject to required approvals," the joint announcement says.

This is a developing story.

Disclosure: In 2023, TMTG sued 20 media organizations, including Axios, for defamation. That suit in Florida is ongoing.

Monday, December 15, 2025

Diablo Canyon approved to resume operation: Write critical LTE: letters@latimes.com

https://www.latimes.com/environment/story/2025-12-11/diablo-canyon-coastal-commission-vote

Diablo Canyon approved to resume operation: Write critical LTE: letters@latimes.com

By Hayley Smith and Noah Haggerty

Dec. 11, 2025 6:35 PM PT

- California’s last nuclear power plant received permission to operate for at least 5 more years in exchange for conserving thousands of acres of land in San Luis Obispo County.

- The agreement between The California Coastal Commission and Pacific Gas & Electric seeks to balance damage to the marine environment going forward.

- Some stakeholders in the region celebrated the deal while others, including a Native tribe, were disappointed.

California environmental regulators on Thursday struck a landmark deal with Pacific Gas & Electric to extend the life of the state’s last remaining nuclear power plant in exchange for thousands of acres of new land conservation in San Luis Obispo County.

PG&E’s agreement with the California Coastal Commission is a key hurdle for the Diablo Canyon nuclear plant to remain online until at least 2030. The plant was slated to close this year, largely due to concerns over seismic safety, but state officials pushed to delay it — saying the plant remains essential for the reliable operation of California’s electrical grid. Diablo Canyon provides nearly 9% of the electricity generated in the state, making it the state’s single largest source.

The Coastal Commission voted 9 to 3 to approve the plan, settling the fate of some 12,000 acres that surround the power plant as a means of compensation for environmental harm caused by its continued operation.

We toured California’s last nuclear power plant. Take a look inside

July 13, 2023

Under the agreement, PG&E will immediately transfer a 4,500-acre parcel on the north side of the property known as the “North Ranch” into a conservation easement and pursue transfer of its ownership to a public agency such as the California Department of Parks and Recreation, a nonprofit land conservation organization or tribe. A purchase by State Parks would result in a more than 50% expansion of the existing Montaña de Oro State Park.

PG&E will also offer a 2,200-acre parcel on the southern part of the property known as “Wild Cherry Canyon” for purchase by a government agency, nonprofit land conservation organization or tribe. In addition, the utility will provide $10 million to plan and manage roughly 25 miles of new public access trails across the entire property.

“It’s going to be something that changes lives on the Central Coast in perpetuity,” Commissioner Christopher Lopez said at the meeting. “This matters to generations that have yet to exist on this planet ... this is going to be a place that so many people mark in their minds as a place that transforms their lives as they visit and recreate and love it in a way most of us can’t even imagine today.”

Critically, the plan could see Diablo Canyon remain operational much longer than the five years dictated by Thursday’s agreement. While the state Legislature only authorized the plant to operate through 2030, PG&E’s federal license renewal would cover 20 years of operations, potentially keeping it online until 2045.

Should that happen, the utility would need to make additional land concessions, including expanding an existing conservation area on the southern part of the property known as the “South Ranch” to 2,500 acres. The plan also includes rights of first refusal for a government agency or a land conservation group to purchase the entirety of the South Ranch, 5,000 acres, along with Wild Cherry Canyon — after 2030.

Pelicans along the concrete breakwater at Pacific Gas and Electric’s Diablo Canyon Power Plant

(Brian van der Brug/Los Angeles Times)

Many stakeholders were frustrated by the carve-out for the South Ranch, but still saw the agreement as an overall victory for Californians.

“It is a once in a lifetime opportunity,” Sen. John Laird (D-Santa Cruz) said in a phone call ahead of Thursday’s vote. “I have not been out there where it has not been breathtakingly beautiful, where it is not this incredible, unique location, where you’re not seeing, for much of it, a human structure anywhere. It is just one of those last unique opportunities to protect very special land near the California coast.”

Oct. 29, 2025

Others, however, described the deal as disappointing and inadequate.

That includes many of the region’s Native Americans who said they felt sidelined by the agreement. The deal does not preclude tribal groups from purchasing the land in the future, but it doesn’t guarantee that or give them priority.

The yak titʸu titʸu yak tiłhini Northern Chumash Tribe of San Luis Obispo County and Region, which met with the Coastal Commission several times in the lead-up to Thursday’s vote, had hoped to see the land returned to them.

Scott Lanthrop is a member of the tribe’s board and has worked on the issue for several years.

“The sad part is our group is not being recognized as the ultimate conservationist,” he told The Times. “Any normal person, if you ask the question, would you rather have a tribal group that is totally connected to earth and wind and water, or would you like to have some state agency or gigantic NGO manage this land, I think the answer would be, ‘Hey, you probably should give it back to the tribe.’”

Tribe chair Mona Tucker said she fears that free public access to the land could end up harming it instead of helping it, as the Coastal Commission intends.

“In my mind, I’m not understanding how taking the land ... is mitigation for marine life,” Tucker said. “It doesn’t change anything as far as impacts to the water. It changes a lot as far as impacts to the land.”

Montaña de Oro State Park. (Christopher Reynolds / Los Angeles Times)

The deal has been complicated by jurisdictional questions, including who can determine what happens to the land. While PG&E owns the North Ranch parcel that could be transferred to State Parks, the South Ranch and Wild Cherry Canyon are owned by its subsidiary, Eureka Energy Company.

What’s more, the California Public Utilities Commission, which regulates utilities such as PG&E, has a Tribal Land Transfer Policy that calls for investor-owned power companies to transfer land they no longer want to Native American tribes.

In the case of Diablo Canyon, the Coastal Commission became the decision maker because it has the job of compensating for environmental harm from the facility’s continued operation. Since the commission determined Diablo’s use of ocean water can’t be avoided, it looked at land conservation as the next best method.

This “out-of-kind” trade-off is a rare, but not unheard of way of making up for the loss of marine life. It’s an approach that is “feasible and more likely to succeed” than several other methods considered, according to the commission’s staff report.

“This plan supports the continued operation of a major source of reliable electricity for California, and is in alignment with our state’s clean energy goals and focus on coastal protection,” Paula Gerfen, Diablo Canyon’s senior vice president and chief nuclear officer, said in a statement.

But Assemblymember Dawn Addis (D-Morro Bay) said the deal was “not the best we can do” — particularly because the fate of the South Ranch now depends on the plant staying in operation beyond 2030.

“I believe the time really is now for the immediate full conservation of the 12,000 [acres], and to bring accountability and trust back for the voters of San Luis Obispo County,” Addis said during the meeting.

There are also concerns about the safety of continuing to operate a nuclear plant in California, with its radioactive waste stored in concrete casks on the site. Diablo Canyon is subject to ground shaking and earthquake hazards, including from the nearby Hosgri Fault and the Shorline Fault, about 2.5 miles and 1 mile from the facility, respectively.

PG&E says the plant has been built to withstand hazards. It completed a seismic hazard assessment in 2024, and determined Diablo Canyon is safe to continue operation through 2030. The Coastal Commission, however, found if the plant operates longer, it would warrant further seismic study.

Earthquake risks and rising costs: The price of operating California’s last nuclear plant

A key development for continuing Diablo Canyon’s operation came in 2022 with Senate Bill 846, which delayed closure by up to five additional years. At the time, California was plagued by rolling blackouts driven extreme heat waves, and state officials were growing wary about taking such a major source of power offline.

But California has made great gains in the last several years — including massive investments in solar energy and battery storage — and some questioned whether the facility is still needed at all.

Others said conserving thousands of acres of land still won’t make up for the harms to the ocean.

“It is unmitigatable,” said David Weisman, executive director of the nonprofit Alliance for Nuclear Responsibility. He noted that the Coastal Commission’s staff report says it would take about 99 years to balance the loss of marine life with the benefits provided by 4,500 acres of land conservation. Twenty more years of operation would take about 305 years to strike that same balance.

But some pointed out that neither the commission nor fisheries data find Diablo’s operations cause declines in marine life. Ocean harm may be overestimated, said Seaver Wang, an oceanographer and the climate and energy director at the Breakthrough Institute, a Berkeley-based research center.

In California’s push to transition to clean energy, every option comes with downsides, Wang said. In the case of nuclear power — which produces no greenhouse gas emissions — it’s all part of the trade off, he said.

“There’s no such thing as impacts-free energy,” he said.

The Coastal Commission’s vote is one of the last remaining obstacles to keeping the plant online. PG&E will also need a final nod from the Regional Water Quality Control Board, which decides on a pollution discharge permit in February.

The federal Nuclear Regulatory Commission will also have to sign off on Diablo’s extension.

rjohnson